With our December 2023 jobs report release it is a good time to reflect on 2023, which in my opinion was a reset year. It appears that we have survived the headwinds of inflation, slowing economy, and return to normal work patterns. We still have extremely low unemployment and solid job growth. Yet most people feel as though something is missing. What makes it therefore a reset year is the reshaping of what was previously normal work patterns.

In this month’s report, we examine:

- Labor market – trending to normal

- Job postings – gearing for a fresh start

- Work schedules – moving from remote to flextime

Stay tuned for our third annual “State of the Workforce” whitepaper coming out in the next few weeks where we dive into many more trends from 2023 and see where the job market appears to be headed in 2024.

Labor Market – Trending to Norms

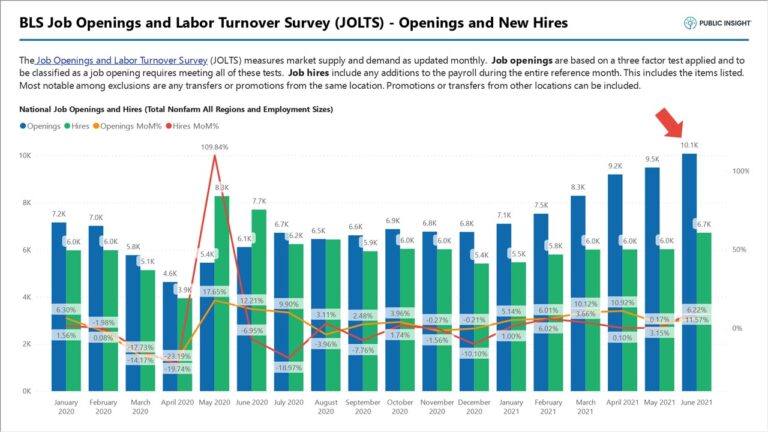

BLS Job Openings and Labor Turnover Survey (JOLTS) provides an overview of the labor market. It is summarized in four primary metrics: hires, openings, quits, and layoffs and discharges. We pulled back the lens a little further by looking at data going back to 2016 and gaining a historical perspective. We have eliminated 2020 as an outlier year to get the best perspective. BLS JOLTS is a month behind so this data is through November.

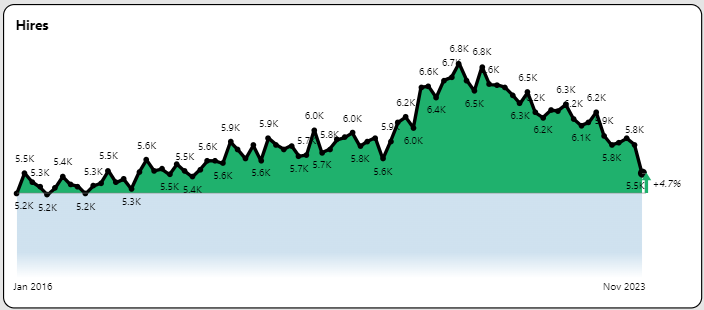

Hires Back to Historical Norms

The number of hires has now come full circle back to historical norms. Hires declined 5% in November to 5.5 million, a 19% decline from the peek of 6.8 million jobs in November 2021. To gain the right perspective however we are now within the range of the normal hiring levels for the past seven years.

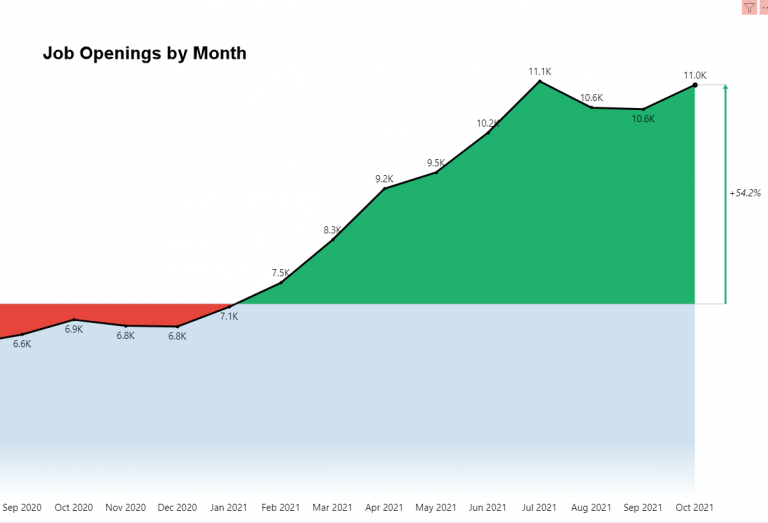

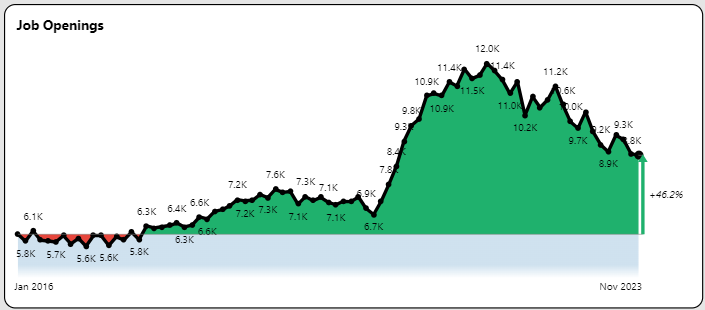

Openings Remain in Elevated Territory

Job openings are an enigma. Job openings have steadily declined from the March 2022 peak of 12 million to 8.8 million. This might otherwise be reason for hand wringing, but the 8.8 million openings is still a 46% premium over 2016 levels and a 15% premium over the previous pre-pandemic high point in 2018.

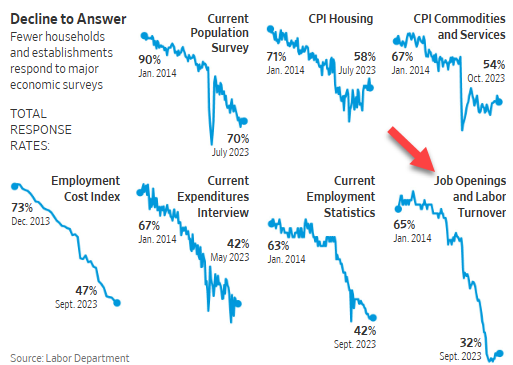

It is entirely possible that there are data quality issues with the JOLTS data. JOLTS data is based on survey responses. Survey responses have declined over 50% in the past ten years. The JOLTS data in particular is the dubious leader of labor market surveys with a paltry 32% response rate as shown in the following graph summarized from a recent Wall Street Journal article.

The definition of job opening could also be resulting in an overstatement. According to BLS guidelines, a job opening must meet the following criteria to be considered open.

- A specific position exists and there is work available for that position.

- The job could start within 30 days, whether or not the establishment finds a suitable candidate during that time.

- There is active recruiting for workers from outside the establishment location that has the opening.

In my opinion, only the last requirement is an external validation. The others are internal estimates. Is it possible that employers are overstating their actual needs?

When we look at job postings we will see that the market validation of these openings as we enter 2024 is highly suspect.

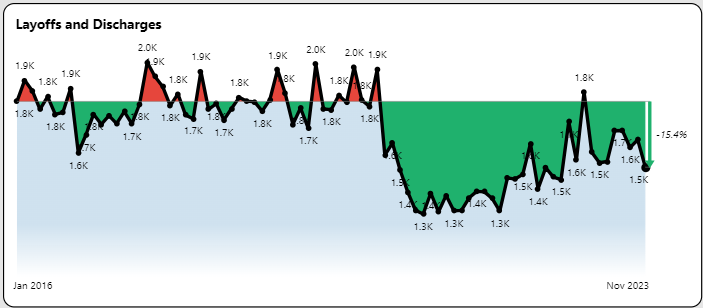

Labor and Discharges at Historic Lows

Mass layoffs always headlines the news, but the number of layoffs continues to slide lower aside from the monthly blips. The graph below shows this big picture perspective.

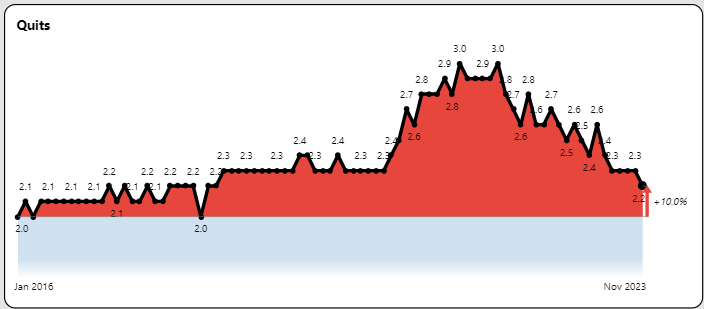

Quit Rates are Back to Normal

Finally quit rates have reverted back to historic norms after dramatic increases during the pandemic. The current quit rate of 2.2% is in line with 2017-2020 levels.

Job Postings – Gearing for a Fresh Start

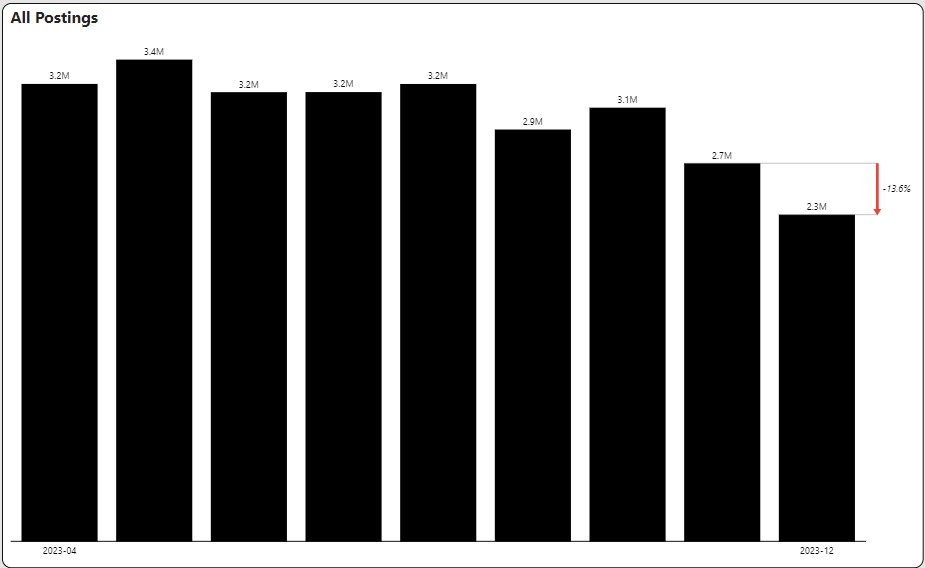

Job postings slumped considerably in 2023 ranging from 15-20% below comparable 2022 levels. December job postings declined 14%.

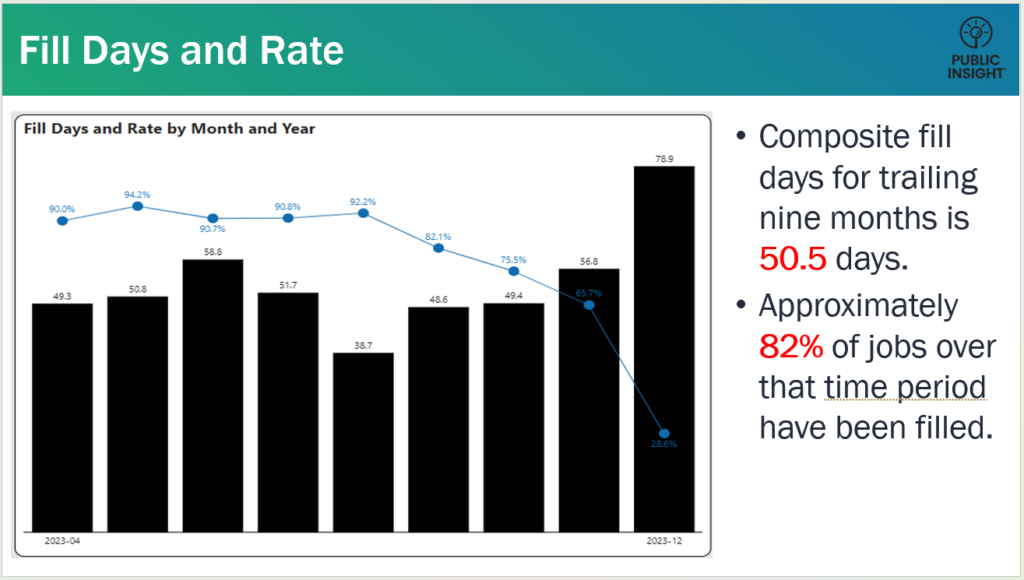

A characteristic of job postings was the continued challenge of filling open jobs. The fill days throughout 2023 ranged between 50 and 60 as shown below.

A closer examination shows that the fill days for December thus far (albeit small fill rates) shows much higher fill days at an average of 78.9. Fill days are estimates based on the oldest or parent posting. It is entirely possible that employers are cleaning out old job posts and positioning for new posting activity in 2024.

Despite this, the open days for December now stands at 119 days which is a sizeable increase from previous months which were 90-100 days.

Work Schedules – From Remote to Flextime

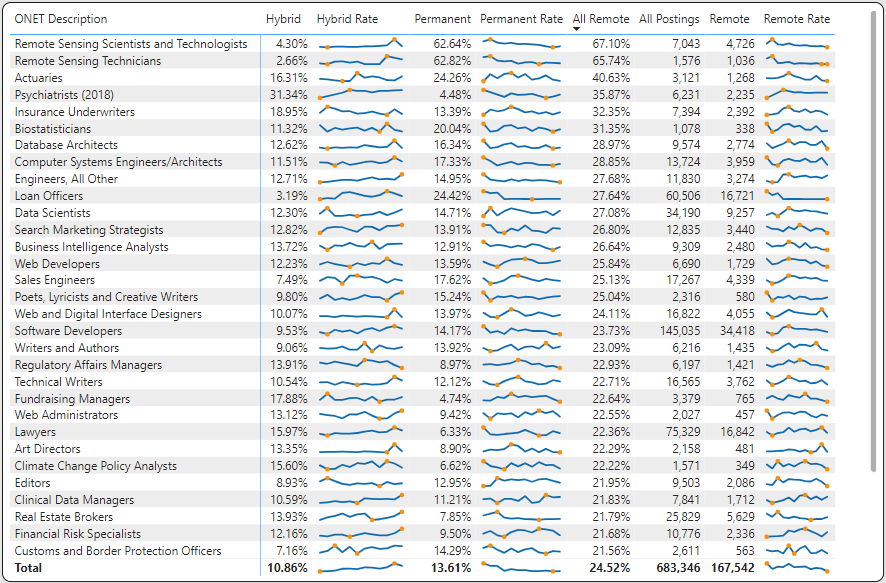

We have seen a steady decline in job postings advertised as remote during 2023. The table below shows the top remote advertised job titles broken down by hybrid and permanent remote. The sparkline graph shows the high and the low point during 2023.

Hybrid remote continues to be the prevalent form of advertised remote work. But this trend seems to be moderating. Permanent remote (or all remote) has been in a free-fall. Most of the job titles saw their lowest percentage of postings in December.

Workers clearly want remote work. It was ultra convenient to be able to stop work, go to a kid’s game or take the dog for a walk. However, many employers across the market require their workers to be on site. Further, employers are increasing mandating in-office participation to improve collaboration and team building. The ultimate compromise is in flex time.

Emergence of Flextime

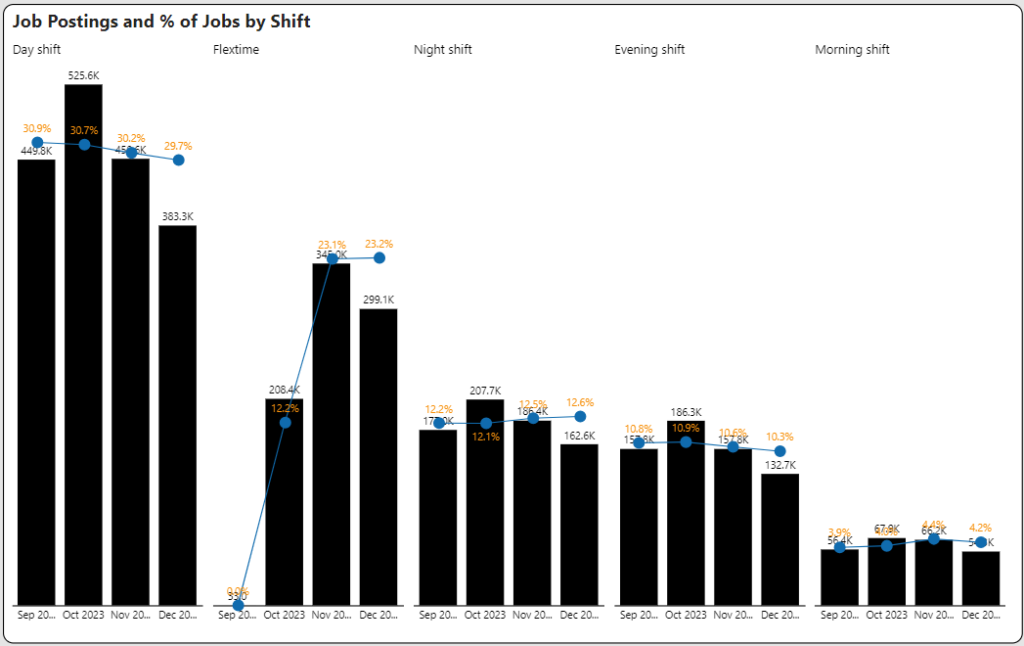

At the end of 2023 we noticed the emergence of flextime as a highly advertised form of work schedule and benefit. Indeed® removed it from the bowels of the position description and put it front and center. Employers are advertising flextime or flexible work scheduling in one out of four postings. To put this in its perspective, this is second to day shifts as the most published form of schedule as shown below.

This rate exceeds evening and morning shifts in its prevalence. Flextime is defined in Indeed as a working schedule with a flexible set of starting and ending hours. Whereas a traditional schedule is from 9 a.m. to 5 p.m. per day, a flex-time schedule allows employees to arrive, for example, at 8:30 a.m. one day and 10 a.m. the next. Employees with flex time schedules work the same number of hours as those with a traditional work schedule.

Flextime requires strong scheduling systems and coordination. The benefit of flextime is that it can apply to many more types of jobs such as health care and retail. Workers have grown accustomed to work-life balance and now expect it.

Get More December 2023 Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and job and talent market data every month.

What is TalentView?

These insights were generated from our TalentView talent market intelligence solution. Integrate our market data into your application, or use our self-service analytics platform. Learn how TalentView can help with talent sourcing, competitive benchmarks, employer brand measurement and solution provider business development and watch a demo.

What’s New in Our Latest TalentView Release?

Zip Code Analysis, LinkedIn® Data, Shift and Benefit Reporting Provide Hyper-Targeted Talent Intelligence for Recruiting and Business Development – Learn How