Why choose Luxembourg for your investment vehicle setup?

5th

Green financial centre in the world

1st

Green financial centre in EU

3,664

funds in Luxembourg

€ 600 bn

bn assets under management

« AAA »

Country rated by Fitch, DBRS, S&P and Moody’s (2023)

Leading centre for cross-border distribution of investment funds

70+

countries where Luxembourg funds are distributed

Unique concentration of multilingual investment fund experts

Available structures :

More information about structures

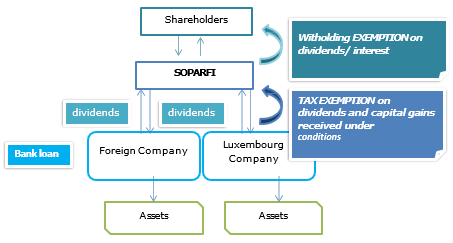

SOPARFI

Holding company: The “Société de Participations Financières” is a type of holding company that is fully admitted to the benefit of the Double Tax Treaties and EU Directives.

While a SOPARFI may have all the same activities of a Holding company, it may also have a related commercial activity such as the management of participations, financing, real estate, etc., or a real commercial/industrial activity in relation to the aim stated in its by-laws.

Thus the SOPARFI could also an activity subject to VAT (i.e. a mixed holding) it is not only to have a Holding activity.

The SOPARFI is so completely compliant with the European Union Parent-Subsidiary Directive.

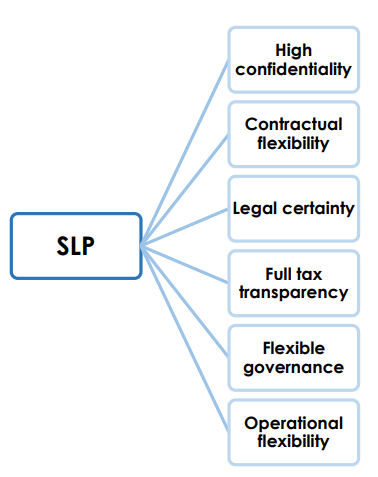

SLP: Special limited partnership

The Special Limited Partnership is a form of companies. It can be incorporated in Luxembourg by one General Partner and one Limited Partner (LP – investor).

- It can be set up within a few weeks

- No prior regulatory approval

- Not required: custodian, audit, prime broker

- Unregulated Alternative Investment Fund under the AIFMD

- Its manager should be regulated only when its AUM is over > 100 Mio (500 Mio for closed-end funds)

- The SLP can invest in any type of assets such as real estate, private equity, equities, participations, hedge fund strategies, loans, bonds, artworks, cars, liquid or illiquid instruments, etc…

- No VAT – Fully Tax transparent – fully tax-exempt in Luxembourg –

- Clearing and settlement of subscriptions with Euroclear – Fundsettle

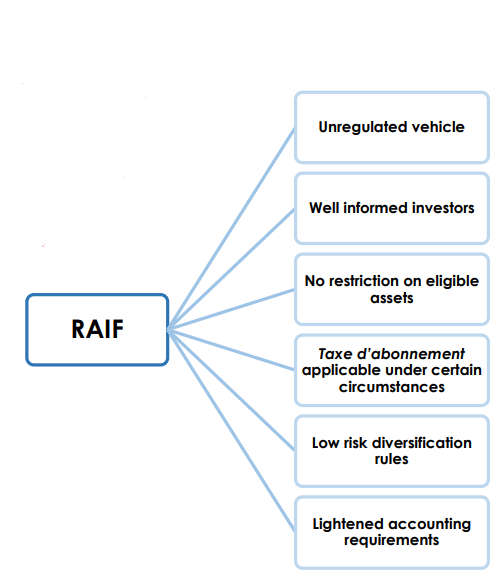

RAIF: Reserved alternative investment fund

– The RAIF is similar to a SIF from an investment policy and tax perspective but is exempt from the CSSF’s authorization and supervision requirements. A RAIF complying with the investment policy of a SICAR could benefit from the same tax treatment as a regulated SICAR.

– The RAIF is meant to close the gap between highly regulated investment vehicles and unregulated AIFs.

– The RAIF is not subject to prior approval and direct supervision by the financial sector supervisory authority (CSSF).

– Indirectly supervised through its manager, it nevertheless benefits from the same structuring flexibility and tax regime as the SIFs or SICARs, not available to unregulated AIFs.

– The RAIF Law provides a comprehensive and attractive tax and legal regime.

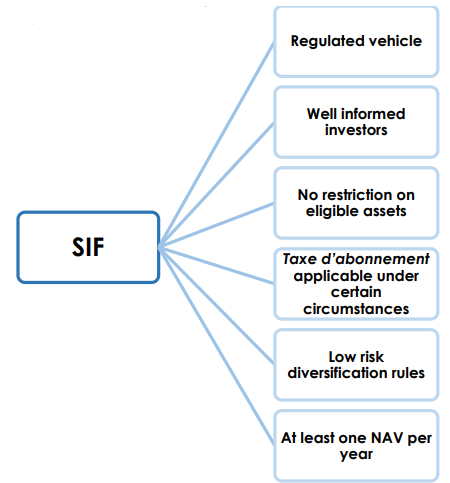

SIF: Specialized investment fund

A Specialized Investment Fund (also called SIF) is an investment fund that can invest in all types of assets including real estate and private equity investment strategies as well as innovative strategies in infrastructure, renewable energy, collectible assets, plain vanilla, alternative, etc…

It can be sold to investors and it is usually qualifies as alternative investment fund (AIF). SIFs can market their shares and if they have appointed an EU AIFM.

SICAR: Investment company in risk capital

The société d’investissement en capital à risque (SICAR) is an investment company in risk capital. It is an investment vehicle that was designed for investments in private equity and venture capital. It can be sold to well-informed investors. SICARs can market their shares or partnership interests via a specific passport to well-informed investors across the EU if they have appointed an EU AIFM.

The SICAR regime is only reserved for well-informed investors whose professional or institutional investors

This type of vehicle is fiscally neutral, operationally flexible, and softly regulated.

UCI II: undertakings for collective investment

UCI II is a fund set up under Part II of the Luxembourg Law of December 17th, 2010 on undertakings for collective investment. UCI is an investment fund that can invest in all kinds of assets. It can be sold to all types of investors and it qualifies as an alternative investment fund (AIF). Part II funds can market their shares, units, or partnership interests via a specific passport to professional investors across the EU if they have appointed an EU AIFM.

A UCI Part II Fund may be constituted in a FCP (Fonds Commun de Placement) or in a SICAV (Société d’Investissement à Capital Variable) and those FCP and SICAV may be established as an umbrella fund with compartments or only as a single fund

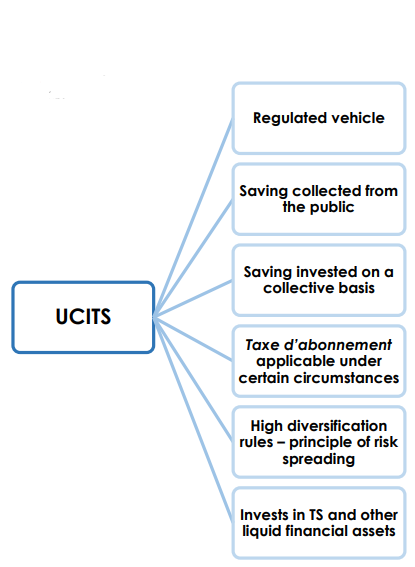

UCITS: undertakings for collective investment in transferable securities

- An Undertaking for Collective Investment in Transferable Securities (UCITS) is an investment fund that invests in liquid assets and can be distributed publicly to retail investors across the EU

- A UCITS must invest its funds in transferable securities and other liquid assets including transferable securities admitted or dealt on a regulated market, financial derivative instruments, investment funds, cash and specific money market instruments.

Why Esperia?

- Offers high-end fund administration and corporate services to business vehicles with personal touch of a small firm;

- Clients involved in various businesses such as Private Equity, Real Estate, Intellectual Property, wealth management, e-commerce, etc

- Provides reliable and responsive tailor-made solutions demonstrating an attention to detail;

- Over 13 years of existence;

- Is independent;

- Worldwide clients range varying from entrepreneurs, family offices, international groups, institutional etc.