Should You Buy A HOC Project? Consider These Pros And Cons!

Before the COVID-19 pandemic struck, it was difficult enough trying to afford a property in Malaysia’s ever-growing property market with new – and oftentimes, pricey – projects mushrooming everywhere.

To put things into perspective, by late 2019, Malaysia’s property overhang registered up to RM41.5 billion with residential properties contributing to 45% of the overhang!

Now that the pandemic has kept people indoors and certain businesses have closed their shutters for good, the property market seems bleak due to poor consumer affordability and unfavourable property prices.

However, all hope is not lost as the Home Ownership Campaign (HOC) that was previously introduced in 2019 is now back (!) until 31st December 2021, as part of the Pemerkasa Plus aid package by the Malaysian government.

Home Ownership Campaign 2020 - 2021

Find properties eligible for HOC discounts on PropertyGuru here

What Is The HOC (Home Ownership Campaign) 2021?

If you’re one of the few who haven't heard of HOC before or just need a quick recall, the HOC (Home Ownership Campaign) is a government initiative designed to support homebuyers.

This time round, the Home Ownership Campaign 2021 is essentially the same as it was in 2019 – to stimulate the property buying process, and encourage the sale of unsold properties.

Buyers will be able to enjoy financial incentives by both the government and developers, to make their property dreams come true!

What’s So Good About HOC 2021?

For starters, homebuyers will be able to enjoy full stamp duty exemption on the Instrument of Transfer for residential properties up to RM1 million, and a partial stamp duty exemption (3%) for those priced between RM1 million to RM2.5 million.

Not only that, but the stamp duty on the Instrument of Securing Loan will also be exempted for residential properties up to RM2.5 million. And best of all, every homebuyer will enjoy a minimum of 10% discount off the purchasing price!

PropertyGuru Tip

Based on the development's <a href="https://www.propertyguru.com.my/property-guides/what-is-apdl-and-why-is-it-so-important-30199" target="_blank" rel="noopener noreferrer">approved APDL</a> pricing, the 10% discount will be applied to that amount. Whereas for properties that do not have a valid APDL anymore (projects that have already <a href="https://www.propertyguru.com.my/property-guides/certificate-of-compliance-and-completion-15904" target="_blank" rel="noopener noreferrer">obtained CCC</a>), the 10% discount is based on its selling price.

As most down payments are 10% of the property’s asking price, this awesome perk means you can save a bit more of your hard-earned money for something else, like the furniture.

Relevant Guide

Here's What To Expect Before You Make A Down Payment!

You might think, “Buying a property is a big step and I can’t quite afford it. Should I really take advantage of HOC 2021 and buy a home?” Luckily for potential homeowners, it’s every buyers’ dream market now.

As there are so many properties in excess, it might be easier to get extra freebies thrown in as part of the purchasing package.

Not only that, but the people you’ll deal with (agents, developers, owners) might also be more accommodating and willing to negotiate, as they’re trying to close a sale after all.

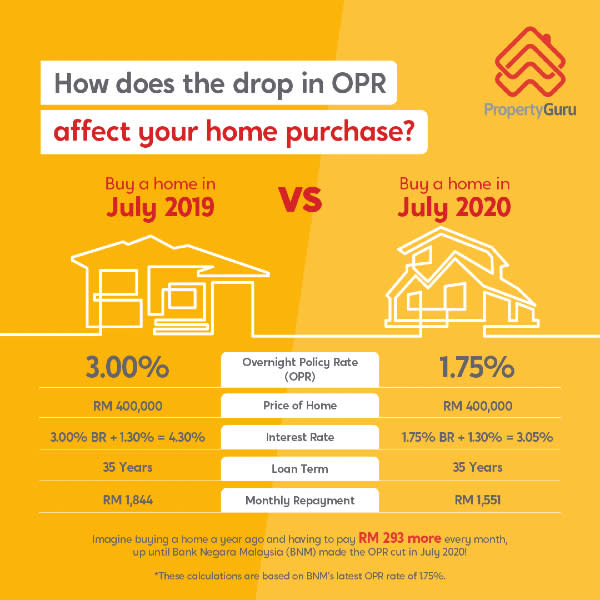

To nudge you in the right direction just a little bit more, the Overnight Policy Rate (OPR) was slashed to 1.75% – the fourth time in 2020 alone, and the lowest level on record!

What this essentially means is, if you take out a loan after the OPR decrease, your loan interest rate will cost less for the time being. Let's take a look at a sample calculation below:

Do bear in mind that the OPR and interest rates are variable and can change (just look at its 2020 history!), so make sure you consider your financials thoroughly before embarking on such a financially heavy decision.

Is A HOC Home The Right Home For Me?

Owning a home in Malaysia has never been easier with the HOC 2021 as you can buy not just one property, but two or three... or more!

BUT, not all the projects under the HOC might be able to fulfil your criteria of a dream home. Why is this so? First off, the Home Ownership Campaign is ONLY for newly launched projects.

If you’re looking for a subsale terraced home in a matured neighbourhood for the charm of something old-school, you'll definitely not be able to find what you’re looking for. In this case, the secondary market would suit you better.

However, if you prefer something fresh off the construction site, is convenient, and compact (like a high-rise project) instead, there are plenty to choose from.

For many aspiring first-time homeowners, the HOC is the perfect opportunity to own a property with plenty of choices of move-in-ready units available.

As the HOC was designed to promote residential home purchases, the properties bought cannot be used and/or converted into commercial activities.

Do note that while Serviced Apartments and SOHOs are typically commercial-titled, they're recognised as a residential property under the Federal Government Gazette, thus they're eligible for HOC.

Although the benefits of the HOC are oh-so-tempting, don’t forget to consider if it’s for your own dwelling or as an investment!

Buying a property in a matured location would be considered a quick investment as many would love to live near their work to reduce commute time, but a property on the outskirts will take time to rent or sell because the location hasn’t been fully developed yet.

The discounts might be the most appealing part, but if you’re considering buying a property as an investment, it’s best to evaluate its full potential and how long you’re willing to wait before you can fetch a good price.

Pros And Cons Of Buying A Project Under HOC 2021

In case you'd like a better overall look at the pros and cons of purchasing a property under the HOC, the table below should be of use to you:

Full stamp duty exemption for Instruments of Transfer (up to RM1 million) | Only for newly launched projects |

Partial stamp duty exemption for Instruments of Transfer (more than RM1 million up to RM2.5 million) | May not be able to enjoy the well-established facilities of a matured neighbourhood if new project is in up-and-coming area |

Full stamp duty exemption on the Instrument of Securing Loan (up to RM2.5 million) | If buying for investment purposes, may need to wait a longer time for the area to be fully developed so that the price can appreciate |

Minimum 10% discount off the development’s purchasing price | Properties bought under HOC for residential purposes only, no commercial activities allowed |

Might be easier to get additional goodies from the developer | |

Overnight Policy Rate (OPR) is at its lowest level ever (1.75%), making it cheaper to borrow money |

Home Ownership Campaign 2020 - 2021

List Of Developers Involved In HOC 2021

Below is a brief list of some of the notable developers involved in the HOC 2021 this time round. Find out if your favourite developers are included!

For something that's a lot more comprehensive, click here for the full list of developers and properties under HOC 2021, all in one place. You're welcome! 😉

Hap Seng Land Sdn Bhd

Chin Hin Property Development

Glomac Berhad

Paramount Property Development

LBS Bina Group

Bandar Nusajaya Development

IJM Land

Sime Darby Property Berhad

Dwitasik Sdn Bhd

Mah Sing Properties

Are You Ready For HOC 2021?

Once you’ve found the property of your dreams and you’re ready to sign those papers, one last thing to do is to check if the project is registered under REHDA (Peninsular Malaysia), SHAREDA (Sabah), or SHEDA (Sarawak) as part of the campaign.

There might be unscrupulous developers looking to take advantage of eager buyers, claiming that the project is part of the HOC when it’s actually not! If the project is not registered under those 3 associations, it is not part of the HOC.

As we’ve said time and time again, purchasing a property is quite a life-changing decision and before jumping straight into it, take the time to sit down and plan things out with extra focus on your finances and long-term plans for the property.

The Home Ownership Campaign will run until 31st December 2021, so if you’ve been on the lookout for good properties, don’t forget to bookmark the PropertyGuru EasyOwn campaign page to find the best HOC deals.

Relevant Guides: