View News

Understanding-Real-Estate-Investment-Trusts-REITs-and-SEBI-Regulations-A-Comprehensive-Overview

Understanding Real Estate Investment Trusts (REITs) and SEBI Regulations A Comprehensive Overview

Meaning of REIT

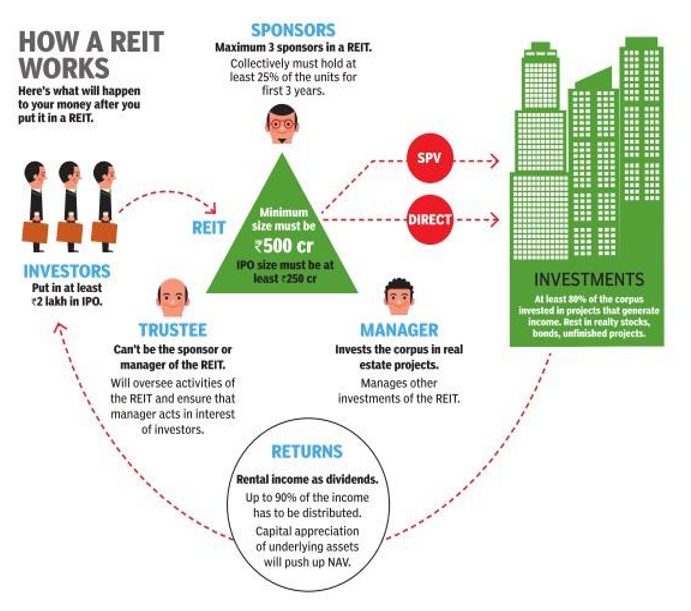

REIT stands for Real Estate Investment Trust. It is a type of investment vehicle or company that allows individuals to invest in real estate assets. REITs own, operate, or finance income-generating properties such as residential buildings, commercial office spaces, retail centers, hotels, and industrial properties.

The primary purpose of a REIT is to generate income from rental or lease payments received from the properties it owns. REITs provide an opportunity for investors to invest in real estate without directly owning or managing properties themselves. Instead, they can purchase shares or units of a REIT, which represents their ownership interest in the underlying real estate portfolio.

REITs are required to distribute a significant portion of their income to shareholders in the form of dividends. In many countries, including the United States, REITs are legally required to distribute a certain percentage of their taxable income to shareholders annually, often around 90%. This distribution feature makes REITs attractive to investors seeking regular income.

By investing in REITs, individuals can gain exposure to the real estate market and potentially benefit from property value appreciation, rental income, and dividend payments. REITs are typically traded on stock exchanges, providing liquidity to investors who wish to buy or sell their shares.

It's important to note that REITs are subject to specific regulations and requirements in each jurisdiction where they operate. These regulations govern aspects such as the types of properties that can be included in a REIT portfolio, the minimum distribution requirements, and the governance structure of the REIT.

Salient Features Of SEBI (REIT) Regulations, 2014

|

Salient Features |

SEBI (REIT) Regulations, 2014 |

|

SEBI (Real Estate Investment Trusts) Regulations, 2014 |

|

Trust set up under Indian Trusts Act, 1882 |

|

Sponsor Group, Re-designated Sponsor, Manager, and Trustee |

|

Each sponsor shall hold or propose to hold a minimum of 5% of units of REITs. Collectively, they should hold a minimum of 25% of the units of the REIT for a period of not less than 3 years from the date of listing. |

|

Shall be registered as a Trustee under SEBI (Debenture Trustee) Regulations, 1993, and shall not be an associate of Sponsor/Manager. |

|

Listing is mandatory for Units |

|

At least 80% of the value of the REIT assets needs to be in completed and revenue-generating properties |

|

Remaining 20% can be invested in: |

|

|

a) Developmental properties |

|

|

b) Listed or unlisted debt of companies/body corporate in the real estate sector |

|

|

c) Mortgage-backed securities |

|

|

d) Equity shares of companies listed on a recognized stock exchange in India deriving at least 75% of their operating income from real estate activity |

|

|

e) Government securities |

|

|

f) Unutilized FSI of a project |

|

|

g) TDR acquired for the purpose of utilization |

|

|

h) Money market instruments or cash equivalents |

|

Full valuation on a yearly basis and updating the same on a half-yearly basis, declaring NAV within 15 days from the date of valuation/update. |

|

|

|

|

At least 90% of the net distributable income after tax of the REIT/Holdco shall be distributed as dividends to the unit holders at least on a half-yearly basis, to be made not later than fifteen days. |

|

- Directly or through SPVs, holding at least 80% of their assets directly in such properties and not investing in other SPVs. |

|

|

- The REIT shall hold controlling interest and not less than 50% of the equity share capital of the Special Purpose Vehicle. |

|

- Under both the initial offer and follow-on offer, rights issue, QIP, the minimum subscription size shall be in the range of 10,000 to 15,000 units. |

|

|

- The units offered to the public in the initial offer shall not be less than 25% of the number of units of the REIT on a post-issue basis. It can be less than 25% subject to certain conditions. |

|

|

- Trading lot shall be 1 unit. |

|

- The aggregate consolidated borrowings and deferred payments of the REIT shall never exceed 49% of the value of the REIT assets. |

|

|

- In case such borrowings/deferred payments exceed 25%, approval from unit holders and credit rating shall be required. |

|

- Minimum offer size should be at least Rs. 250 crore. |

|

|

- Value of Assets by REIT shall be at least Rs. 500 crores. |

|

|

- Minimum Number of Unit holders other than sponsor(s), its related parties, and its associates forming part of the public shall be at least 200. |

Issue And Allotment Of Units

- Initial Offer: A REIT must make its initial offer of units through a public issue.

- Preconditions for Initial Offer:

Registration: The REIT must be registered with SEBI under the REIT Regulations.

Asset Value: The value of the REIT assets owned must be at least Rs. 500 crores.

Minimum Unit Holders: The REIT must have a minimum of 200 unit holders (excluding sponsors, related parties, and associates).

Offer Size: The offer size should be at least Rs. 250 crores.

Compliance of Asset Ownership and Size: The requirements of asset ownership and size (Rs. 500 crores) can be fulfilled before the allotment of units, as long as there is a binding agreement with relevant parties. A declaration must be made to SEBI and the designated stock exchanges, with adequate disclosures in the offer document.

- Units Offered to the Public:

a) If the post-issue capital of the REIT (calculated at the offer price) is less than Rs. 1,600 crores, the units offered to the public should be at least 25% of the total outstanding units.

b) If the post-issue capital is equal to or more than Rs. 1,600 crores but less than Rs. 4,000 crores, the units offered to the public should have a value of at least Rs. 400 crores.

c) If the post-issue capital is equal to or more than Rs. 4,000 crores, the units offered to the public should be at least 10% of the total outstanding units. Units offered to sponsors, managers, related parties, or associates will not be counted.

- Subsequent Issues: The REIT can issue units through follow-on offers, preferential allotment, qualified institutional placement, rights issue, bonus issue, offer for sale, or any other mechanism specified by SEBI.

- Filing of Offer Document: The REIT, through a merchant banker, must file a draft offer document with the designated stock exchange(s) and SEBI, at least 30 working days before filing the offer document.

- Public Disclosure: The draft offer document filed with SEBI must be made public for comments, by hosting it on the websites of SEBI, designated stock exchanges, and associated merchant bankers for a period of at least 21 days.

- Due Diligence: The draft and/or final offer document must be accompanied by a due diligence certificate signed by the lead merchant banker.

- SEBI Comments: SEBI may provide comments to the lead merchant banker and request modifications in the draft offer document for investor protection.

- Incorporating SEBI Comments: The lead merchant banker must incorporate all comments received from SEBI on the draft offer document before filing the final offer document with the designated stock exchanges.

- Filing Offer Document: If no observations are issued by SEBI on the draft offer document within 21 working days, the REIT can file the offer document or follow-on offer document with SEBI and the stock exchange(s).

- Timely Filing: The offer document must be filed with the designated stock exchanges and SEBI at least 5 working days before the opening of the offer.

- Time Limit for Offer: The initial offer, follow-on offer, or rights issue must be made within one year from the date of SEBI's observations. If not, a fresh draft offer document must be filed.

- Subscription and Allotment: The REIT can invite subscriptions and allot units to both resident and foreign investors, subject to guidelines specified by RBI and the government for foreign investors.

Listing And Trading Of Units

Mandatory Listing: After the initial offer, all units of the REIT must be listed on a recognized stock exchange with nationwide trading terminals within 12 working days from the closure of the offer.

Listing Agreement: The listing of REIT units should be done according to the listing agreement between the REIT and the designated stock exchange.

Non-Listing Consequences: If listing permission is not received from the stock exchange(s) or if the Observation Letter issued by SEBI is withdrawn, the units will not be eligible for listing. In such cases, the REIT must refund the subscription monies, if any, to the allottees immediately, along with interest at a rate of 15% per annum from the date of allotment.

Trading and Clearing: Units of the REIT listed on recognized stock exchanges should be traded, cleared, and settled as per the bye-laws of the respective stock exchanges and the conditions specified by SEBI.

Trading Lot: The trading lot for REIT units is 1 unit.

Redemption of Units: The REIT can redeem units through buy-back or at the time of delisting.

Listing Continuity: Unless delisted under REIT Regulations, the units of the REIT will remain listed on the designated stock exchange.

Minimum Public Holding: The listed REIT must maintain a minimum public holding in accordance with the conditions specified under the "Issue and Allotment of Units" section. Failure to comply may result in action by SEBI and the designated stock exchange, including delisting of units. The trustee can provide a six-month period to the manager to rectify any breach of conditions, and if not rectified, the manager must apply for delisting of units.

Lock-in Period for Pre-IPO Unit Holders: Any person other than the sponsor(s) holding units of the REIT before the initial offer must hold the units for a minimum period of one year from the date of listing, subject to circulars or guidelines issued by SEBI.

Additional Requirements: SEBI and the designated stock exchanges may issue guidelines or circulars to specify other requirements related to the listing and trading of REIT units.

Disclosures

Offer Document Disclosures: The manager of the REIT must ensure that the disclosures in the offer document comply with Schedule II of the REIT Regulations and any circulars or guidelines issued by SEBI.

Annual and Half-Yearly Reports: The manager must submit an annual report to all unit holders within three months from the end of the financial year. Additionally, a half-yearly report must be submitted within 45 days from the end of the half-year ending on September 30th. These reports should contain the disclosures specified under Schedule IV of the REIT Regulations.

Disclosure of Information: The manager of the REIT is required to disclose important information to the designated stock exchanges regarding the REIT's operation and performance. This includes significant events such as property acquisitions or disposals that exceed 5% of the REIT's asset value, additional borrowings exceeding 5% of the REIT's asset value, issuing of additional units, credit ratings, approvals by unit holders, legal proceedings, notices and results of unit holders' meetings, non-compliance with REIT Regulations, and breaches of specified limits. The manager must also share this information with the designated stock exchanges and unit holders as per the listing agreement requirements.

Participation by Strategic Investors

Definition of Strategic Investor: A strategic investor can be an infrastructure finance company registered with RBI as an NBFC, a Scheduled Commercial Bank, an international multilateral financial institution, a systemically important NBFC with RBI, a foreign portfolio investor, an insurance company registered with the IRDA, or a mutual fund.

Holding Requirements: Strategic investors must invest jointly or severally not less than 5% of the total offer size of the REIT or an amount specified by SEBI. Public holding (excluding strategic investors and sponsors) must be a minimum of 25%, and sponsor holding can be a minimum of 5% and a maximum of 70%.

Issue Price and Fund Utilization: The price at which units are offered to strategic investors must not be less than the price determined in the public issue. The subscription amount must be kept in a separate account until the public issue opens.

Lock-in Period: Units subscribed by strategic investors, as per the unit subscription agreement, will be locked-in for a period of 180 days from the date of listing in the public issue.

“Unlock the Potential of Legal Expertise with LegallMantra.net - Your Trusted Legal Consultancy Partner”

Article Compiled by:-

Mayank Garg

(LegalMantra.net Team)

+91 9582627751

Disclaimer: Every effort has been made to avoid errors or omissions in this material in spite of this, errors may creep in. Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next edition In no event the author shall be liable for any direct indirect, special or incidental damage resulting from or arising out of or in connection with the use of this information Many sources have been considered including newspapers, Journals, Bare Acts, Case Materials , Charted Secretary, RBI etc.