Credit-risk concerns hanging over buoyant Schuldschein market in 2018

#Debt #Privateplacement #Schuldschein Financial difficulties at Carillion and Steinhoff are set to constrain growth in the Schuldschein private-debt market this year, after record issuance of EUR27bn in 2017, by refocusing investors’ minds on credit risk which could cap growth in deal volume. Click here to download the full 4 -page study

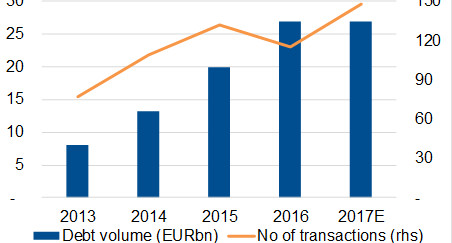

Financial difficulties at former Schuldschein (SSD) issuers Carillion and Steinhoff are set to constrain growth in the SSD private-debt market this year after record issuance worth EUR 27bn from around 150 issuers, a strong jump in the number of borrowers, and tightening spreads last year. Troubles at the two big SSD issuers may refocus investors’ minds on credit risk, nudge spreads wider and cap growth in deal volume.

Underlying resilience

Scope Ratings expects the market to remain resilient, with the value of deals set to exceed EUR 20bn in 2018, but lag the levels of 2016 and 2017. Investor appetite for private debt is evident in that around 150 companies tapped the market last year, up from around 115 in 2016, including companies from Eastern Europe, the Middle East and Asia making the German debt instrument truly pan-European. There were, however, fewer jumbo deals of EUR500m or more. The data still point to a private-debt market whose growing depth and breadth show that it has continued to mature, becoming less reliant on fund raising by large German companies than in the past.

The SSD remained a borrower’s market in 2017. Scope’s analysis shows that the median spread over the reference rate (EURIOR) for five-year tranches of SSD debt narrowed to 110 basis points from 138 bps in 2016, with spreads tightening in the second half of the year from around 118 bps in H1 2017.

Alarm bells

Scope believes such a robust performance may be hard to repeat this year. Tighter spreads contrast with the alarm bells set off by the financial difficulties at Carillion, which issued SSD worth GBP 112m in early 2017, and Steinhoff, which issued EUR 730m in 2015. It is true that defaults or debt restructurings among SSD issuers before 2017, typically from companies which raised funds in relatively small amounts, have had little impact on overall demand and scrutiny involved in the analysis for new transactions.

Scope believes that this might be somewhat different this time, for three reasons:

- First, the two companies which set off the alarm bells raised relatively large amounts of money for the SSD segment.

- Secondly, any restructuring of the Carillion and Steinhoff debt would involve a larger group of international investors than has typically been the case in the past. There are more than 50 investors in each deal so it might turn out to be difficult to restructure the debt. Any restructuring of SSD debt requires the unanimous agreement of investors as opposed to a simple majority required in the case of listed bonds or syndicated loans.

- Lastly, the short time between SSD issuance and a credit event might raise questions about how the creditworthiness of these companies was assessed in the first place. Scope believes investors need to be careful in assuming the high credit quality of the SSD market in the past will automatically apply in the future when there are many new entrants, often with different characteristics from earlier issuers.

Despite the market’s long history, it hasn’t experienced a full credit cycle since becoming more diverse by sector and geography. The SSD segment looks ready to be more equally balanced between the interests of investors and borrowers in 2018.

Keeping the balance in the market

Scope believes that the market will find its balance between offering yield to investors without diluting average credit quality any further. Originators, issuers and investors retain large interest in a functioning market, particularly in light of the limited liquidity for and 'hold-to-maturity character' of SSD deals. As more than 80% of SSD issuers remain publicly unrated, diligent scrutiny of new deals/issuers is required. We believe that most recent credit events are a wake-up call for arrangers and investors not to rush into deals. At the same time, overall investor interest in private debt remains strong.